| “Risk and time are on opposite sides of the same coin. If there were no tomorrow, there would be no risk.” – Peter Bernstein

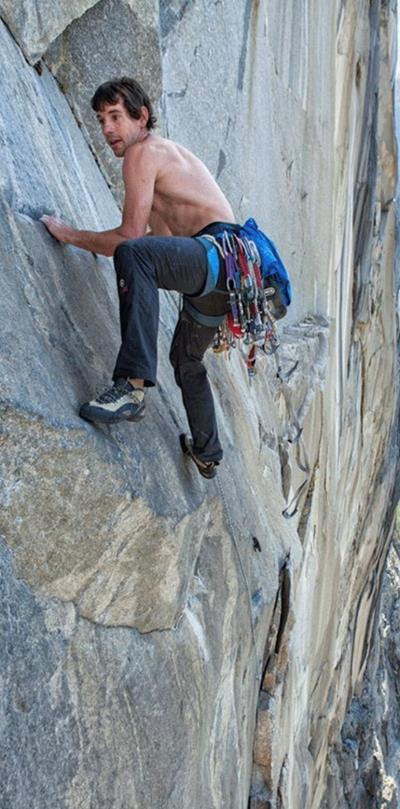

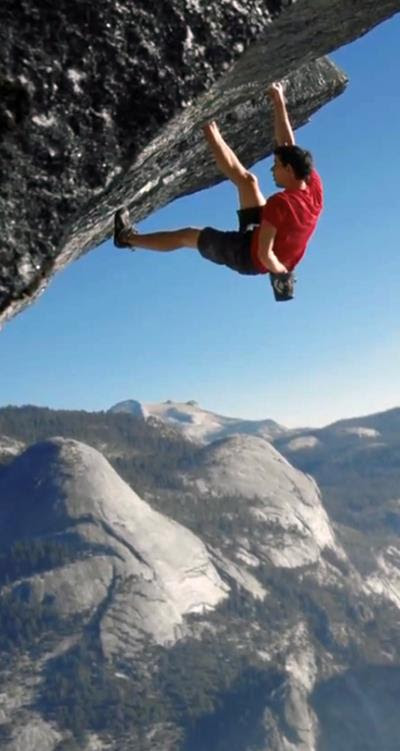

Several years ago, I spoke with Alex Honnold at the Telluride Film Festival. Honnold is an American rock climber best known for his free solo ascent of El Capitan, the subject of the academy award documentary, Free Solo:

https://youtu.be/Tgc5hBSS2lU

In a most positive way I told him, “There is something wrong with you.” It turns out my quip had more truth than was known at the time. Alex Honnold’s amygdala, the portion of the brain registering fear, doesn’t activate – dangerous situations don’t elicit an emotional reaction.

Honnold doesn’t just go out and climb walls, rather, he spends a great amount of time charting the best safe climb. He searches for answers to his mountaineering questions. Fear may not be present for Honnold, but process is, and process prevails. Honnold doesn’t just go out and climb walls, rather, he spends a great amount of time charting the best safe climb. He searches for answers to his mountaineering questions. Fear may not be present for Honnold, but process is, and process prevails.

Your amygdala probably works as intended so if you are looking to purchase a home (or sell and then purchase) questions are abundant and fear the result of lack of information. Risk is at play.

Risk can be defined as “A situation involving exposure to danger.”

Your risk/concern may involve:

1. Home pricing (Will it crater like 2007?)

2. Mortgage rates (Should I wait to see if rates fall?)

3. How do I time the sale and purchase of my next home? (I must have a place to live.)

4. What is the best negotiation strategy? (Nothing like four years ago.)

5. How do I find the home’s value relative to asking price? (Hint: It’s not Zillow.)

It’s human nature to focus on loss more than reward, the downsides vs. the upsides. This is an evolutionary instinct to keep us safe.

Like Honnold, it’s important to break down each component of the homebuying process to understand risk, what you may gain or lose and how to hedge against bad outcomes.

Homebuyer Associates are Exclusive Buyer Agents. That means we only work for the interests of the buyer and search for any ethical edge we can find for our clients to help mitigate risk.

Traditional agents don’t work in the buyer’s interest. You’ll have to ask part-time buyer agents who they work for – when they are part of a “team” that sells and buys.

Daniel Kahneman writes of two kinds of risk in his book, “Thinking Fast and Slow.” Fast risk and slow risk. An example of fast risk is driving without a seatbelt.

A fast risk in real estate is buying a home at any price without objective information on value or waiving an inspection to increase your chance of offer acceptance. Metaphorically speaking, the result may be the same as a car crash while not wearing a seatbelt.

Bias against fast risk can prevent you from buying a home, one of the very assets that help build wealth in the long run. Our goal is to protect against t the fast risk. Bias against fast risk can prevent you from buying a home, one of the very assets that help build wealth in the long run. Our goal is to protect against t the fast risk.

Slow risk is the accumulation of bad decisions that lead to an unwanted outcome over time, developing heart disease after decades of eating poorly is one example.

Delaying a home purchase while waiting for interest rates to fall is an example of a real estate slow risk. If you purchase a home with a 6.8% mortgage and rates drop you then refinance. Waiting for rates to drop while home prices increase is a slow risk.

Nora Ephron wrote, “Never trust a man who says trust me” but trust me, I don’t see home prices falling soon because of limited inventory. Rates may in time return to 5%-5.5% – unless we encounter another financial crisis.

Begin your home search as Honnold does his climbs, meticulous planning to get answers to questions. If you begin your “climb” while those who fear risk stop, the advantage is yours. Begin your home search as Honnold does his climbs, meticulous planning to get answers to questions. If you begin your “climb” while those who fear risk stop, the advantage is yours.

Yes, I write about real estate but the above has application to life. I hope you find your risk tolerance, your balance and live your best life.Thanks for reading,

Michael D. Holloway

Homebuyer Associates

414.254.4129

www.homebuyerassociates.com

homebuyeba@gmail.com

Michael D. Holloway / Seamus Holloway / Mike Dupar

This email was sent to homebuyeba@gmail.com.

You may instantly unsubscribe , or forward this e-note to a friend. |

![]()

![]()